Federal Support

Employment Insurance

The Government of Canada is taking immediate, significant and decisive action to help Canadians facing hardship as a result of the COVID-19 outbreak.

If, as a sessional, you have taught 630+ hours over the last 52 weeks you are eligible for EI.*

One 3-credit studio course = 112 hours

One 3-credit academic course = 140 hours

To apply for EI, contact our Payroll department directly to request a Record of Employment (ROE). Turnaround time is pretty quick.

* It is possible to get approval for higher number of hours. There are occasions where people can report higher numbers that accurately reflect what was actually worked.

EI Application:

https://www.canada.ca/en/services/benefits/ei/ei-regular-benefit.html

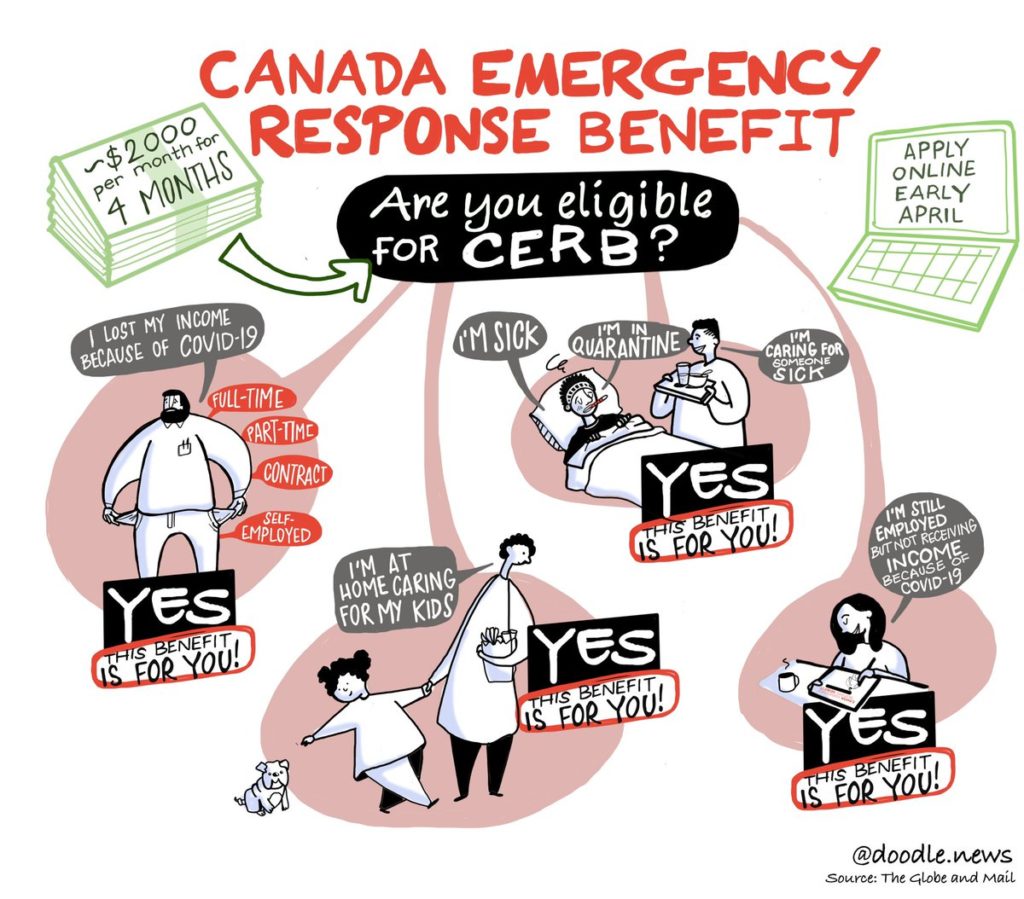

CERB

If you have stopped working because of COVID-19, the Canada Emergency Response Benefit (CERB) may provide you with temporary income support. The CERB provides $500 a week for up to 16 weeks.

CERB Application:

https://www.canada.ca/en/services/benefits/ei/cerb-application.html

Provincial Support

https://news.gov.bc.ca/releases/2020PREM0013-000545

BC is the only province so far to provide financial relief to renters. The Temporary Renter Supplement will pay up to $500 per month (for 4 months) directly to landlords on behalf of workers who qualify for the federal CERB.

Temporary Rental Supplement Program:

Other broad-based BC measures include free bus trips in Metro Vancouver via TransLink and the rest of BC Transit operations across the province.

Find the benefits relevant to you

https://newsinteractives.cbc.ca/coronavirusbenefits

Get information on what’s available to: those who have lost income; renters and homeowners; families; seniors; students; businesses; Canadians abroad. There’s also a personal finance section with information on tax and utility bill deferrals. This guide provides the basic benefit information you need to apply for subsidies.

This includes:

- Who can apply

- Date available

- How to apply

- Links or phone number to make a claim

If you have any questions or additional support resources, please leave a comment below or email ecuadfa@gmail.com